Our Paul B Insurance Statements

Wiki Article

Paul B Insurance for Dummies

Table of ContentsPaul B Insurance - An OverviewSome Of Paul B InsuranceThe Ultimate Guide To Paul B InsuranceNot known Incorrect Statements About Paul B Insurance The Buzz on Paul B Insurance

With a stipend, an employer uses a set amount of cash to their workers to assist them pay for an individual medical insurance plan and various other health-related out-of-pocket expenses. The amount is generally contributed to the staff members' incomes as taxable earnings often, such as regular monthly, quarterly, or yearly.They additionally aren't a formal advantage, so they're normally simpler to take care of and have less management prices. Because they aren't a formal benefit, workers can use their stipend to acquire whatever they desire. While you might want your staff members to use the money on health insurance or medical costs, they aren't called for to do so, neither can you ask for proof that they purchased a health insurance policy.

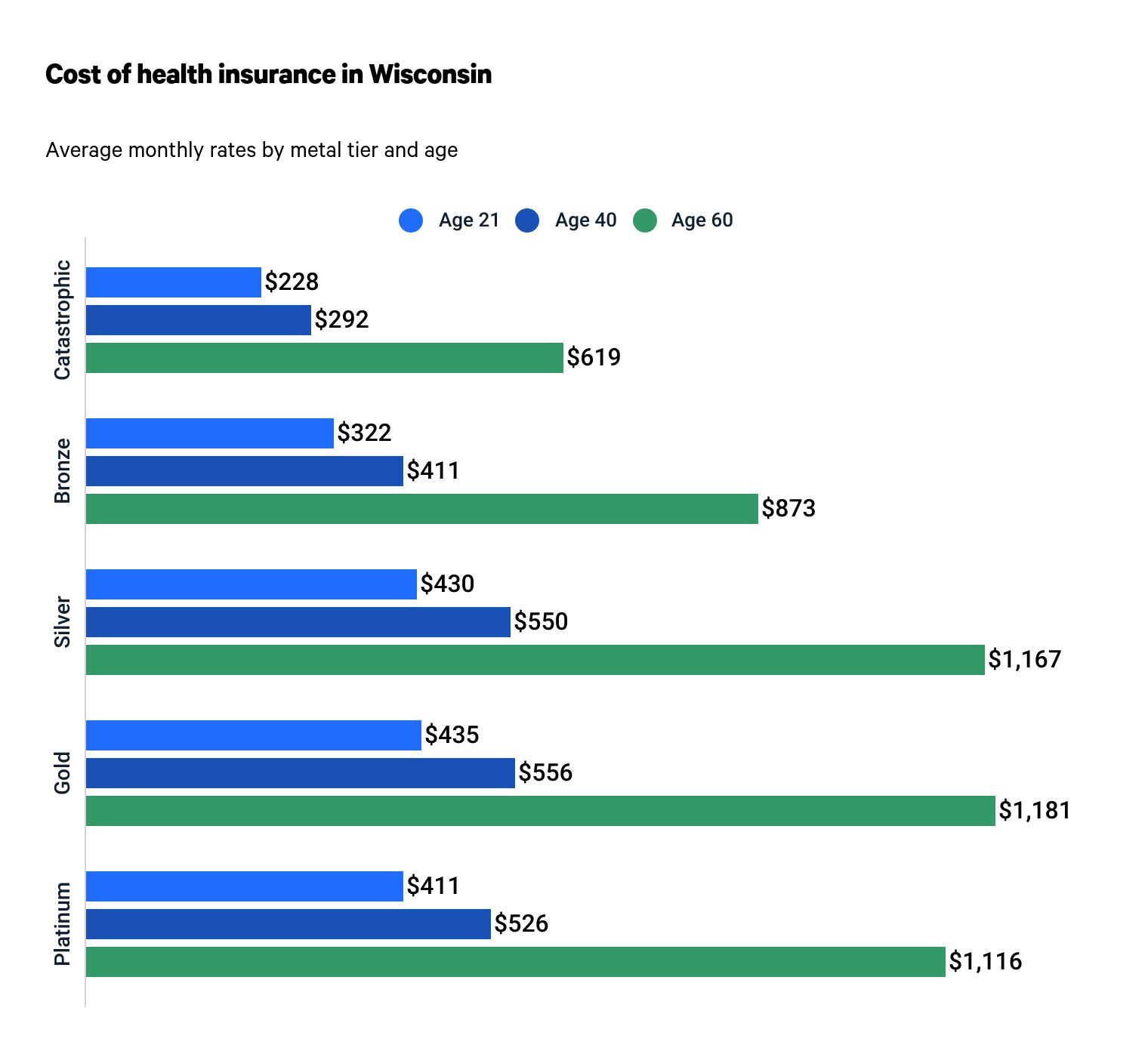

Hospital cover is readily available in four different rates, namely Gold, Silver, Bronze, and also Basic, each covering a mandated list of treatments. Because Gold plans cover all 38 kinds of therapies detailed by the federal government, they likewise come with the most pricey costs.

About Paul B Insurance

In 2017, the average insurance coverage premium for US families with employer-sponsored medical insurance price $18 764, a boost of 3% over the previous year. What this mean value hides, nonetheless, is the substantial difference in the quantity of wellness treatment gotten by different people in the United States. vinnstock/i, Stock/Getty Images That difference is shown in substantial disparities in wellness care spending.

Policies focused on boosting this function of medical insurance consist of covering annual out-of-pocket costs, ending life time benefit restrictions, and ensuring coverage for people with pre-existing problems. 2. Although the academic function of insurance policy might be security from catastrophic occasions, an extra typical function of medical insurance in the United States is even more akin to a club membership than cars and truck insurance coverage.

Aids for country hospitals transfer wealth out of cities and suburban areas. As well as of training course, wellness insurance policy functions via risk pooling, which is to say, transferring riches from the healthy to the ill. That health and wellness insurance policy has disparate functions may discuss why plan manufacturers can come to greatly different reform propositions.

A Biased View of Paul B Insurance

A subsequent evaluation of employees' compensation cases as well as the extent to which absence, spirits and working with great workers were troubles at these firms reveals the positive effects of supplying health and wellness insurance coverage. When contrasted to companies that did not supply medical insurance, it shows up that offering emphasis resulted in enhancements in the ability to work with good employees, reductions in the number of employees' payment cases check here and decreases in the degree to which absence and performance were problems for FOCUS businesses.

Six records have been launched, consisting of "Care Without Insurance Coverage: Insufficient, Far Too Late," which discovers that working-age Americans without health and wellness insurance are extra most likely to receive inadequate healthcare and obtain it far too late, be sicker as well as die faster and get poorer care when they remain in the hospital, also for intense circumstances like a car accident - Paul B Insurance.

What Does Paul B Insurance Mean?

The research writers additionally keep in mind that broadening insurance coverage would likely lead to a boost in genuine resource expense (despite who pays), because the without insurance obtain regarding half as much treatment as the independently insured. Health and wellness Affairs released the research online: "Just How Much Medical Care Do the Without Insurance Usage, as well as Who Spends for It?.".

A health and wellness insurance coverage strategy is a type of insurance policy that intends to supply you as well as your family with the economic capability to spend for any kind of regrettable incident that needs treatment as well as hospitalization. If you're really feeling unpredictable concerning obtaining one, here's what you require to know concerning health and wellness insurance as well as the pros and disadvantages of availing a health insurance coverage plan to assist you decide.

, at the same time, provide treatment a little similar to HMOs, yet the difference exists in its arrangement. Physicians, dentists, and also healthcare carriers make their solutions at lower prices through the PPO. You access to this network by paying a charge to the PPO, or you can seek out-of-network clinical solutions that provide limited coverage.

What Does Paul B Insurance Mean?

Lower prices for reputable health treatment vs. out of pocket expenses if you do not have a health insurance plan Access to readily have a peek at this site available clinical focus Wide selection of plans that use an array of advantages suitable to your health and wellness and also health The primary downside to obtaining health insurance policy is the cost, as the various health insurance coverage strategies can warrant higher costs loved one to several factors including the condition of your health and wellness, your age, your way of life, and so on. Expensive costs due to pre-existing wellness conditions (health and wellness insurance policy companies need those with specific pre-existing health conditions to pay a higher costs because of the higher possibility they have of utilizing the insurance policy as well as the cost it would take for therapies and also hospitalizations) Confusing policies, given the similarities and also differences of each health care insurance coverage strategy If your plan doesn't cover the medical focus or solution that you need, or if the healthcare facility expenses exceed the allowed insurance coverage, you will certainly still top article have to shell out some money Weigh your alternatives as well as very carefully identify which health insurance policy strategy works best for you and also your family members.Report this wiki page